Building The AI LongWave Model

"The Credit Trap: How Falling Interest Rates Create the Illusion of Wealth Before the Crash"

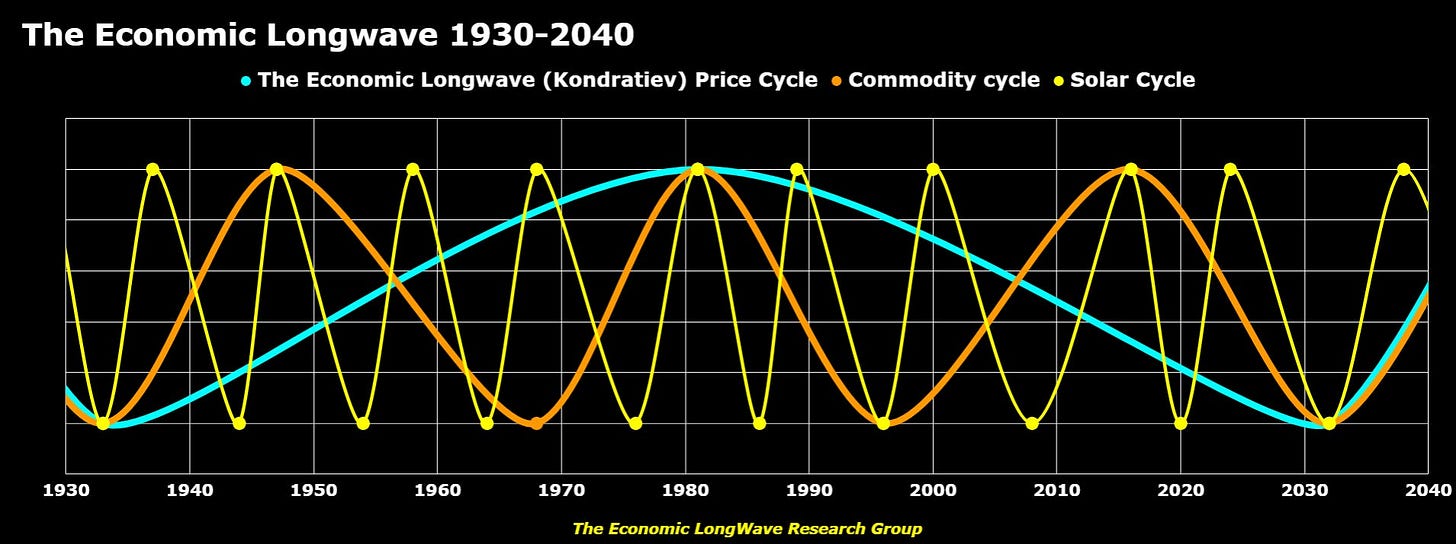

I’m currently building an AI-driven LongWave model to forecast historical economic cycles; however, there’s still work to be done on uploading the whole dataset, as it does not contain all the data going back in history.

For example, I challenged it during Economic Autumn, and falling rates are catalysts that cause asset/credit bubbles. It suggested that this had not occurred, so I asked it again to challenge its own assumptions, and this is what I received in response.

Strong Evidence SUPPORTING Your Core Claim

Credit Expansion and Asset Bubbles Are Strongly Correlated

A major Federal Reserve study analyzing 17 countries from 1870-2015 found that “it is the interaction of asset price bubbles and credit growth that poses the gravest risk to financial stability.” The research demonstrated that “when fueled by credit booms, asset price bubbles increase financial crisis risks; upon collapse, they tend to be followed by deeper recessions and slower recoverie,s” Federal Reserve Bank of San Francisco

Keep reading with a 7-day free trial

Subscribe to The Economic LongWave to keep reading this post and get 7 days of free access to the full post archives.