The Great Bubble Parade: How 400 Years of Data Reveals We're Entering Economic Winter

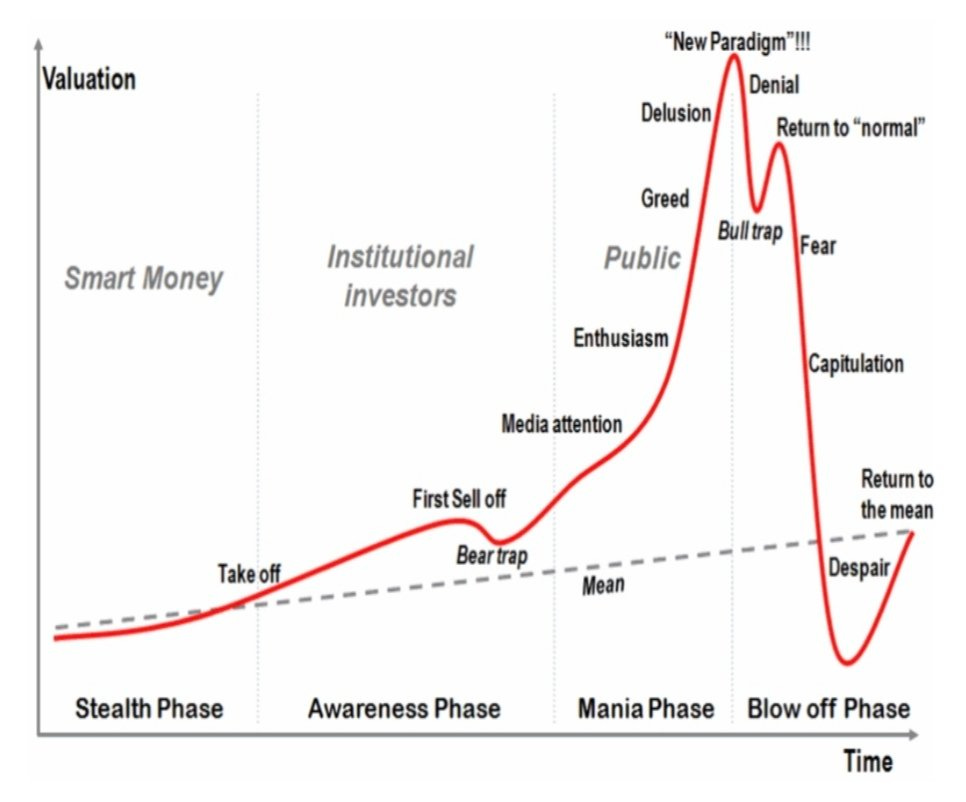

A comprehensive analysis of 56 major financial bubbles reveals a devastating pattern - and suggests the worst is yet to come.

The 85.63% Rule: Four Centuries of Consistent Carnage

After analyzing 56 major financial bubbles spanning from the Dutch Tulip Bubble of 1637 to today's AI mania, one number stands above all others: 85.63%. This is the average loss experienced when speculative bubbles inevitably burst, and it represents one of the most consistent patterns in financial history.

But here's what makes this particularly relevant today: since 2008, we've witnessed an unprecedented acceleration in bubble formation. What historically occurred every 7-10 years now happens multiple times per year, creating what I call "The Great Bubble Parade" - a relentless succession of speculative manias that signals we're approaching what Nikolai Kondratieff predicted would be an economic "winter" of unprecedented scope.

The Post-2008 Bubble Inventory: A Relentless Parade

The evidence is overwhelming. Since the 2008 financial crisis, we've experienced:

3D Printing Bubble (2012-2014): Companies saw 80-90% crashes as reality met hype about "revolutionary" manufacturing technology.

Cannabis Stocks Bubble (2018-2021): Top cannabis stocks returned as high as 360% based on hopes for U.S. federal legalization that never materialized. Companies like Tilray crashed from $300 to pennies.

Clean Energy/Solar Bubble (2020-2021): Renewable energy stocks saw gains exceeding 140%, with the Invesco WilderHill Clean Energy ETF rising over 200%. Tesla rose six-fold, while some solar companies experienced even more extreme multiples before crashing.

SPAC Bubble (2020-2021): Special Purpose Acquisition Companies representing $53 billion in investments accounted for half of all IPOs, providing a pathway for pre-revenue companies to go public. Most have since crashed 70-90%.

Meme Stocks Bubble (2021): GameStop exploded from under $20 to nearly $483 (a 2,300% gain), while AMC jumped similar amounts, driven by Reddit's WallStreetBets community targeting heavily shorted stocks.

AI Bubble (2023-2025): Currently ongoing, with AI stocks drawing comparisons to the dot-com bubble and analysts predicting a 2025 burst as companies struggle to monetize massive investments.

This acceleration in bubble frequency is not random. It represents a fundamental shift in the economic cycle that aligns perfectly with Kondratieff's long-wave theory.

Real Estate: The Crown Jewel of Destruction

While the overall bubble average is a devastating 85.63%, real estate bubbles are even worse, averaging 93.67% losses. This makes housing the most destructive asset class in bubble history, which is particularly concerning given the current global real estate situation.

From our historical analysis, the real estate casualties include complete wipeouts of major financial institutions:

Fannie Mae: +12,696% → -100%

Freddie Mac: +3,089% → -100%

Beazer Homes USA: +1,427% → -100%

Novastar Financial: +4,491% → -100%

The pattern shows that 44% of real estate bubbles result in complete wipeouts, while the minimum loss was still 82% - meaning there are no "soft landings" in real estate bubble history.

The Global Housing Superbubble: Four Continents, One Disaster

Today, we're witnessing something unprecedented: simultaneous real estate bubbles across all major economies, each at different stages of what history suggests will be devastating collapses.

Canada: Currently showing an 18% decline from its February 2022 peak, with Toronto driving national averages down and Vancouver inventory surging 39%. However, this "soft landing" defies 400 years of bubble history. With Vancouver homeownership costs at 97% of median income and Toronto at 75%, Canada appears to be in the early stages of what could become a 93%+ collapse.

United States: Despite volatile conditions, home prices remain at record levels, with the median hitting $403,700 in March 2025 - up from $280,700 in March 2020. However, spring selling season momentum has weakened significantly, and housing supply is building toward the dangerous 13-month oversupply that triggered 2008's collapse.

Europe: Shows dramatic regional variation, with Germany's existing home prices down 14% while Southern European markets continue rising. The European Central Bank has explicitly warned that real estate could trigger "the next crisis," and Nordic countries have seen particularly severe corrections with Stockholm down 16% from peak.

China: Experiencing the world's largest housing bust, with the sector representing 29% of GDP at its peak. Beijing prices have fallen 10-30%, residential sales are down 31%, and major developers like Evergrande (defaulting on $300 billion) have collapsed. JPMorgan economists believe the crash will continue through 2025 at minimum.

Kondratieff Wave Analysis: Winter is Coming

This global bubble parade perfectly aligns with Nikolai Kondratieff's long-wave theory, which predicted economic cycles lasting 40-60 years. According to this framework, we remain in the centralized fourth wave that began around 1950, and we're approaching the "winter" phase - a period of economic contraction, debt deflation, and structural reform typically lasting 10-15 years.

The evidence is compelling:

Bubble Acceleration: The frequency of bubbles has increased exponentially since 2008, suggesting we're in the final speculative phase before the deflationary crash.

Debt Saturation: Global debt levels now exceed those of 2008 across all major economies, limiting central banks' ability to respond to the next crisis.

Demographic Decline: Aging populations in all major economies are reducing natural demand for housing and consumption, creating deflationary pressure.

Central Bank Exhaustion: After years of quantitative easing and near-zero interest rates, monetary policymakers have limited ammunition for the next crisis.

Schumpeter's Creative Destruction: The Technology Connection

Joseph Schumpeter's concept of creative destruction helps explain why these bubbles occur with such regularity despite their obvious destructive nature. Each major technological shift creates both winners and losers:

The internet bubble destroyed thousands of companies but cleared the way for genuine innovators like Amazon and Google. The 3D printing bubble cleared speculative excess while advancing manufacturing technology. The clean energy bubble concentrated enormous capital into solar and wind development, dramatically reducing costs even as speculative companies failed.

Today's AI bubble represents the latest iteration of this process - massive capital concentration into artificial intelligence development, despite unclear monetization paths for most companies. History suggests this will end in 80-90% losses for most AI stocks, but the underlying technology will emerge stronger and more practical.

Socioeconomic Forces: Why We Never Learn

The consistency of the 85.63% average loss across four centuries reveals unchanging human psychology, amplified by modern technology:

Social Media Amplification: Reddit, Twitter, and TikTok create instant global coordination of speculation, allowing bubbles to form faster and reach greater extremes than ever before.

FOMO Psychology: Fear of missing out drives mass participation in obviously overvalued assets, overriding rational analysis.

Easy Money Policies: Zero interest rates and quantitative easing have created enormous liquidity seeking returns, inflating multiple asset classes simultaneously.

Generational Wealth Gaps: Young investors turn to speculation as traditional wealth-building becomes unaffordable, creating desperate risk-taking behavior.

Technological Mystique: Each new innovation justifies "this time is different" thinking, despite identical patterns playing out repeatedly.

Current Warning Signs: The Perfect Storm

Several factors suggest we're approaching the climax of this bubble cycle:

AI Valuations: Extreme price-to-sales ratios with unclear paths to profitability, reminiscent of 1999-2000 dot-com levels.

Global Housing Metrics: Record price-to-income ratios across all major economies, with some markets (Vancouver, Hong Kong, Sydney) showing ratios never seen in history.

Central Bank Policy: Interest rates already cut aggressively with limited room for further stimulus, while quantitative tightening removes liquidity from markets.

Demographic Trends: Birth rates below replacement level in all developed economies, reducing long-term demand for housing and consumption.

Geopolitical Instability: Rising tensions between major powers creating uncertainty that historically triggers flight from speculative assets.

Investment Implications: Preparing for Economic Winter…..

Keep reading with a 7-day free trial

Subscribe to The Economic LongWave to keep reading this post and get 7 days of free access to the full post archives.